Median prices at

Data Input

TzaraNet works with all sorts of data, under all circumstances. Pretending that a tool failed to work because the market conditions were outside the range, were abnormal, the market was too volatile, or whatever, is too convenient an excuse to account for its lack of predictivity. TzaraNet does not need to invoke such excuses. If data leads to a topological network, then, TzaraNet will work for this data all the time. In the field of finance, securities, commodities, futures, currency exchange rates, etc. can be input.

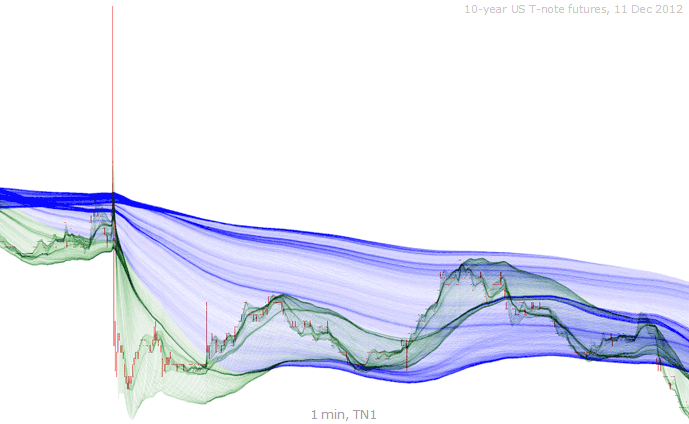

TzaraNet deals with all sorts of data, namely financial instruments. Even bad, strange or weirdly volatile data are handled well, as in this example, where the topological network is unaffected.

Highly volatile instruments do not usually pose a problem, and the topological network "knows" how to tell the "background noise" apart from the significant data, as you can see for yourself.

When "crazy" prices would completely wreak havoc on other tools or black boxes, TzaraNet does fine. One can even tell if a price is normal or an artifact, by looking at the cords.

Do not assume that "lousy" looking data leads to lousy charts. As long as the data is legitimate, a topological network will form and embed the price inside it, allowing for predictions.

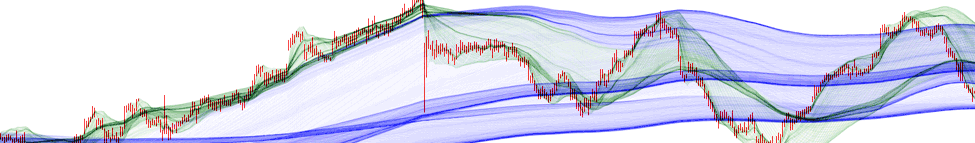

Specific to TzaraNext is NVB data. NVB data, which intrinsically takes into account normalized trading volumes, offers superior or complementary topological networks to minute bars’ networks.

Sometimes, the topological networks formed with min bars and NVB bars can be quite different. When it is the case, the possibilities of prediction are even superior, thanks to confrontation.

At times, the min bars produce an easier-to-exploit chart, which can be indicative of a poor source of data, with unrepresentative volumes. Note that here, the NVB chart remains instructive.

The minute chart seems superior to the corresponding NVB chart, not in terms of interactions, but in terms of their precision. Rarely the case, this could reveal suboptimal volume representation.

Even though the NVBs are superior here (due to lack of homogeneity in activity), the min chart brings a couple of very useful interactions, accounting for local extrema, absent in the NVB chart.

In this example, the superiority of NVBs over minute is clear-cut. It will always be the case when the trading activity lacks homogeneity, as can be the case with instruments also open at night.

Obviously, stock data, if not TzaraNet’s favorite, is TzaraNet’s choice of data par excellence, considering how many stocks there are in the stock exchanges on all five continents.

Since stocks volumes are always available, displaying them under NVB is the way to go in order to get the best topological networks possible.

Index data, which do not come with volumes (or rarely), can therefore only be used as minute bars. They usually provide easy-to-predict topological networks due to the data quality though.

Futures are professionally traded instruments that are perfect for generating excellent topological networks, in terms of precision and richness of interaction.

Commodity prices, such as cocoa or live cattle, lead to perfectly predictable networks. This is, a priori, not evident, in the context of the current paradigm in the field of finance.

Forex instruments, popular among traders, are excellent candidates for TzaraNet, from short to long timeframes. Note that volumes do not exist on the Forex, thus no NVBs are offered.

The forex also offers a few precious metals, which also work great with TzaraNet, as one can see with these silver charts of all resolutions.

Last but not least are the interest rate data, such as T-bond and T-note futures, which are also very interesting instruments, in terms of characteristic figures, as far as TzaraNet is concerned.

| TzaraNet deals with all sorts of data, namely financial instruments. Even bad, strange or weirdly volatile data are handled well, as in this example, where the topological network is unaffected. |