Median prices at

Predictions

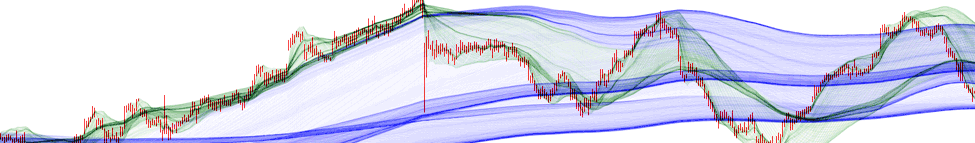

TzaraNet is a highly predictive tool, both qualitatively and quantitatively. Predictions rely on human analysis of TzaraNet charts. It is relatively easy because of the topological nature of the TzaraNet tool, which puts the emphasis on shapes, and because visual patterns keep reappearing again and again. By remembering previously encountered patterns, just like one passively remembers human faces or landscapes, and the associated evolutions of the price, one can easily predict what will happen the next time a similar pattern is seen. Of course predictions can be made without knowing any patterns by simply analyzing the effect of characteristic figures on the price. Whether spotting known patterns or examining cords, the process is completely natural and intuitive.

Once the user has understood how characteristic figures worked and has started seeing patterns previously encountered, predictions become easy and intuitive.

This kind of configuration is common and trivial to predict. It is top buildup exit where the price, after series of logical rebounds got funneled, leaving only one escape, figuratively speaking.

An expert eye can spot the rise brake and thin air on this 1 minute chart, by the darkening and thickening of the driving cord, but thanks to higher resolution charts, prediction is even easier.

With the help of the corresponding 60 minute chart, it is a trivial exercise to understand that this steady rise was short-lived and doomed to be followed by a fall after hitting the green cord.

Here is a slightly more complicated example, where one could think without too much experience that the price will keep rising. But look at the 10 minute chart to see what is going to happen.

The 10 minute chart was very bullish, anticipating a false recovery. Confronting two or more resolutions makes predictions easier, and sometimes even trivial, as in this example.

Let’s try here to examine a chart as it would normally evolve over time. Large arrows show average price movements between major characteristic figures.

The price movements are relatively simple, wrapping around a central cord. Here, the effect of smaller characteristic figures (smaller arrows) does not obfuscate the average movements.

The price jumped to the bottom of the network in preparation for an easy to guess "umbrella" (common pattern). Once the price gets under the network, the fall is straight (see long arrow).

When looking closely, even small price movements are determined by smaller characteristic figures, as revealed by the detailed arrows. The end of the fall coincides with the fall brake.

The little journeying (grayed) can only run into and wrap around the thick blue cord (since there are no other cords nearby) and the price is left at the end with no other option than a top exit.

By looking at the smaller arrows, it is much easier to understand that it is unavoidable for the price to make a top exit at the end of the sticking section around the thick blue cord.

Sometimes, the topological network is so simple that the predictions are trivial to make. This is the case, for example, when there are few, well spread out, characteristic figures.

It is important to be able to tell the major characteristic figures and the resulting average price movements apart from the smaller characteristic figures and detailed price movements.

Help of the corresponding higher resolution chart is precious to making a prediction easily. It not only provides a longer range topological context, but also accounts for local extrema (circled).

Some local extrema sometimes interact with cords under different resolutions (pink and green circles). Sometimes, local extrema can only be explained thanks to higher resolution charts.

When characteristic figures are scarce, as in this 10 NVB chart, a higher resolution chart is likely to account for local extrema, as it clearly does in this example.

This is the same chart a bit later, where one can see that the 60 NVB chart keeps providing elements (mostly the very thick cord) to explain the local extrema seen in the 10 NVB chart

When confronting this 1 NVB chart with the corresponding 10 NVB chart, the 3 circled local extrema become much more understandable, thus predictable.

One day later, the (temporary) end to this drop can be easily predicted with great accuracy thanks to the major cord that is present on the 10 NVB chart.

Another way of improving predictions consists in confronting TNs. One can clearly see through cross examination that local extrema are accounted for either on the TN1 or the TN2 chart.

The dotted line arrows correspond to interactions provided by the other TN. As you can see, the combination of both TNs covers all the price movements

In this TN2/TN3 confrontation, one can see again that local extrema that are outside the scope of one TN interact with characteristic figures present in the topological network of the other TN.

Green arrows correspond to interactions from the TN2 chart, whereas pink arrows correspond to interactions from the TN3 chart. With both charts, almost all the price movements are explained.

When the topological network is simple, seemingly easy to predict, it is interesting to display another TN to at least confirm the analysis.

As shown by the red arrows, some interactions are confirmed by the other TN. Note that a detailed examination shows that some local interactions are only visible under the higher TN.

In this example, the higher TN provides more clues, but the combination of the two is again very useful.

The red arrows illustrate once more how combining TNs has a synergistic effect on the predictions that one can make.

So far, we have kept it simple by combining only two different TNs, but there is no reason not to confront all the TNs, for even more predictive power and reliability.

Thanks to the red circles, one can see how one can make good use of each TN in order to predict each price movement. It would obviously be easier using larger charts, as in TzaraNext.

Last but not least is the ability of TzaraNet to predict that nothing is going to happen (which is still a prediction). This is also precious information that can save people from making a bad decision.

When the network is horizontal and compact, the price keeps wrapping around it. Note that even though the price oscillates, it does so by interacting with characteristic figures, as it always does.

| Once the user has understood how characteristic figures worked and has started seeing patterns previously encountered, predictions become easy and intuitive. |