Median prices at

- TzaraNext Software

- TzaraNet Charts

- TNs (Curve Subtypes)

- NVBs

- 8 Resolutions

- Full Multi-Screen Support

- Linking

- Turnaround Alerts

- Software & Customer Support

- Other Important Features

- System Requirements

Test Trial

Try TzaraNext for free

- All options

- 15-day trial period

-

Turnaround Alerts

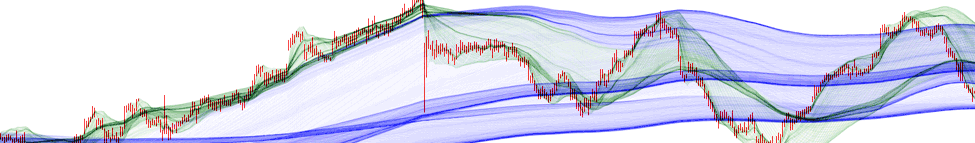

TzaraNext is proud to introduce Turnaround Alerts™ (patent pending), a new type of alert taking full advantage of the characteristic figures and patterns of TzaraNet. These alerts can warn the user of a trend reversal.

A Turnaround Alert, here, a downturn, consists in positioning 2 price lines strategically, so that a possible trend reversal triggers an alert at an early stage. This animation shows how it works.

When the alert is triggered, a window pops up. Colored circles have been drawn to help you understand the relationship between the two alert lines and the topological network.

Here is a second example of a downturn. The first line marks the conditional price (dotted), and the second one the alert price. As long as the dotted line has not been crossed, nothing happens…

One can see that the conditional price was crossed at 31.34, and the turnaround alert was triggered at 30.67 (when the alert price was crossed).

The upturn alert works the same way, but in the opposite direction. If one anticipates a rebound on the cord, followed by a top exit, one should set the conditional price right above the cord.

The anticipated scenario did occur, and the user was warned immediately. Turnaround alerts could not be used without a topological network. It is the cords that make it possible.

It is clear that a rebound on the dense pack of cords implies a "rise resumption", especially as soon as the top green cord is crossed. Thus, the strategic placements of upturn alert price lines...

The primary goal of Turnaround Alerts is to warn the user of a reversal trend. However, they can be used for other scenarios, such as for rise or fall resumptions, top or bottom exits, etc.

One could hesitate between a baseball cap and an umbrella. Setting up a downturn alert can confirm the scenario while being away. Placing a conditional price line just below the next group...

…of cords, and an alert price line somewhere underneath the "anticipated" network confirmed the umbrella. After this Turnaround Alert was triggered, the price could only keep dropping.

Anticipating a trend reversal after a long fall, an upturn alert was set with conditional and alert price lines placed right above and underneath the green and blue cords, respectively.

Thanks to the extreme precision of TzaraNet, lines were well placed, and the user was warned of the trend reversal, long before the price started its rise.

This is another illustration of the exact same scenario (since they repeat themselves), where upturn alert price lines are placed similarly. Note, incidentally, the bad bar that was filtered out.

Not only was the trend reversal confirmed, but the user is here left with ample time to make a decision because of the price journeying around the thick blue cord.

Concentration of the topological network is usually followed by a violent exit. An upturn alert can be used to get notified of such an exit at an early stage.

The positions of the upturn alert price lines were above the cords this time, due to the slope of the cords. One always needs to extrapolate the position of the cords when setting price lines.

| A Turnaround Alert, here, a downturn, consists in positioning 2 price lines strategically, so that a possible trend reversal triggers an alert at an early stage. This animation shows how it works. |