Median prices at

What Makes TzaraNet Special

When a tool, whether a model or a technical analysis indicator (or "study"), fails at predicting, its proponents explain that market conditions fall outside of its scope. What would one think of a weather forecasting model that would stop working when it is a bit warm, a bit cold, a bit windy, or outside of North America? It would certainly not be convenient, and would be inherently suspicious.

TzaraNet works whatever the timeframe, whatever the Instrument, and whatever the market conditions. Think of the implications of this claim, if true.

Any data of any instrument can be input in TzaraNet. This always leads to a topological network, as with this very inactive instrument. This is what makes TzaraNet universal.

Even the most volatile instruments lead to quality topological networks. Below, the high volatility does not prevent identification of a trend reversal from a series of solid interactions with cords.

With indecisive prices, a network still forms. When a central pack of cords forms, prices always return to the pack, no matter the price fluctuations, which is paramount (see paradigm change).

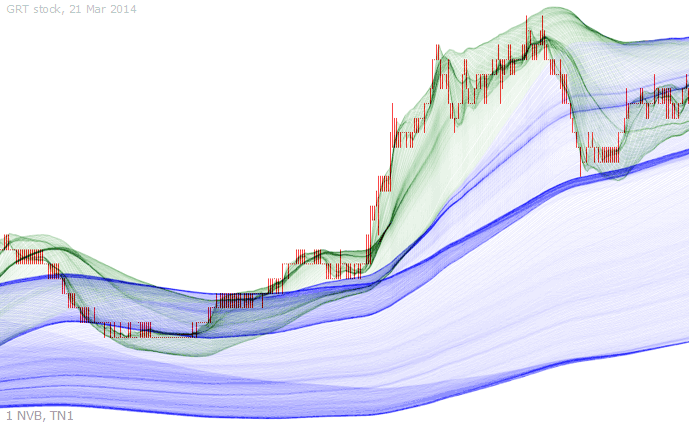

One of the best tests to assess the universality of a tool is to input minute and NVB data and compare results. Only if results are compatible, as in the case of TzaraNet, is the tool universal.

Universality allows one to display, among other things, the same instrument under different resolutions, including NVBs, in any TN (curve subtype).

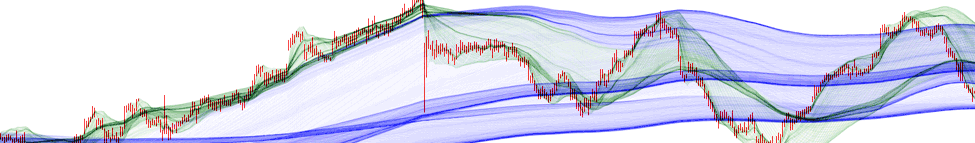

Needless to say, stocks are natural candidates for TzaraNet, as one can see in the example below. In passing, notice how precise the interactions of the price with the two bottom cords are.

Not only do indices produce topological networks, but they usually also allow for easy and precise predictions, due to the reduced volatility of these instruments, by definition.

Futures are ideal, just like indices, for TzaraNet. One can see below a future on a foreign exchange pair in TN4, showcasing nice interactions with cords.

Commodities, too, work perfectly with TzaraNet. Whether directly, or in the form of futures, like in the example below, they usually produce strong characteristic figures.

Interest rate instruments work just as well. Here is an example in TN3 of downward journeying in a series of steps bouncing off characteristic figures.

We would not have covered all the types of instruments that are perfect for TzaraNet without showing a beautiful forex chart. Notice this unusual and interesting trend reversal onset.

Forex also deals with commodities (precious metals), giving rise to excellent topological networks, as evidenced by this striking TN4 chart for silver.

| Any data of any instrument can be input in TzaraNet. This always leads to a topological network, as with this very inactive instrument. This is what makes TzaraNet universal. |